TOPIC - 1

Term insurance Vs whole life insurance: Which is right for you?

Choosing between term life and whole life insurance depends on your financial goals, budget, and need for either affordable protection or lifelong coverage with savings benefits.

Term life or whole life insurance – which should one choose? This question troubles many, as both serve different purposes and the choice depends on an individual’s financial goal. As the name suggests, term insurance is like renting a policy for a specific period. If the policyholder passes away during this term, the insurer pays a death benefit to the nominee. In contrast, a whole life insurance policy provides life-long coverage and includes a savings component.

Let’s explore the key features and differences between both types of insurance plans and understand the specific needs they address.

Term life insurance is most suited to a person for basic protection of his family’s financial future. It is the tool that makes sure that when you are not around, your loved ones will have a certain sum of money, which will enable them to bear the loss without having to worry about immediate income related problems.

The reason it is called term insurance is that in earlier times this contract was valid for a certain period (6 months, 1 year, 5 years etc) hence the work TERM. “However, today we have term plans which offer long-term coverage of 40-50 years and even up to the age of 100. Since some customers, particularly in India, were not comfortable paying money for such long periods with no returns if they survived, the Indian Insurance industry also introduced Term with return of premium (TROP) products

When a person dies, the government taxes the legal heir on their inheritance. However, insurance is tax-free. Hence, an insurance plan was developed wherein people invested with the specific purpose of creating a legacy and passing on the inheritance in a tax-free manner.

• A person would start paying the premium, and his policy would have both a sum assured, like a term plan, but also cash value would get built up like an endowment or a bank account.

• At the time of the person’s death, whichever of the two, sum assured or the cash value, would be greater would get passed onto the nominee or the legal heir of the customer.”

Whole Life insurance has been popular in India with companies like LIC, Max Life, ICICI Prudential, and several others offering the same. Inheritance is largely tax-free in India, so the original purpose of whole life might not fit Indian customers just yet. However, tax laws can change suddenly and therefore that is a factor to be kept in mind. Even without the aspect of taxation, we recommend whole life insurance plans as a great way to build a savings pool that can be used to save in a long-term tax-advantaged instrument.

Whole of Life plans are now offered in both traditional and unit-linked versions.”

“Term life insurance offers coverage for a specific period, typically 10, 20, or 30 years. It is generally more affordable, making it an excellent choice for those seeking high coverage at a lower cost. This option is particularly suitable for young families, homeowners with mortgages, or individuals with specific financial obligations that will decrease over time.”

He contrasts this with whole life insurance.

“On the other hand, whole life insurance provides lifelong coverage and includes an investment component, known as cash value. While it comes with higher premiums, it provides the security of guaranteed coverage for life and the potential for cash value growth. This option may be beneficial for those with long-term dependents, estate planning needs, or those seeking a forced savings vehicle.”

Practical advice for choosing between the two.“The decision between term and whole life insurance ultimately depends on your individual circumstances, financial goals, and budget. When it comes to purchasing an insurance policy, always remember that the best one is the one that provides adequate protection for your loved ones and aligns with your financial strategy.”

TOPIC - 2

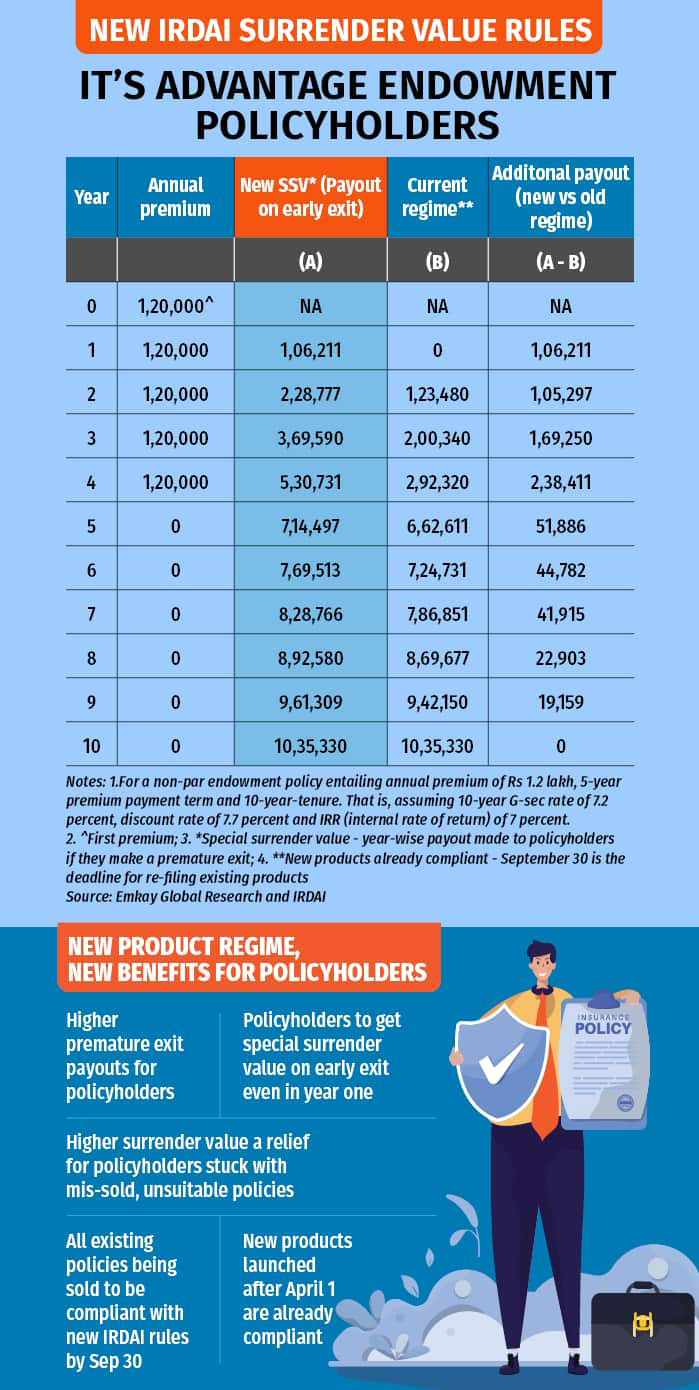

New IRDAI rules: Life insurance policyholders to get higher early-exit payouts from October 1

Policyholders stuck with IRDAI's product, special surrender value rules will get higher premium refund on early exit Come October, and the new higher-payouts-on-early-exit regime will commence in the life insurance space. This is part of the larger, updated insurance product regulations issued by the Insurance Regulatory and Development Authority of India (IRDAI) in March, followed by the master circular with detailed norms in June. While the rules were already applicable to new products launched since then, the regulator had granted life insurance companies time till September 30 to re-file their existing plans to comply with the new norms.

Lower penalty for premature exit

In simple terms, compared to the present scenario, the special surrender value (SSV) — payout on premature exit — for endowment policyholders because of mis-selling or inability to pay premiums will go up. Unlike now, when policyholders lose the entire premium paid if they exit after year one, once the new policy kicks in, they will get a part of their premium back. For insurers, their margins in the non-participating, guaranteed-return category of endowment plans will be the most affected. There will be no change in the surrender value of unit-linked insurance policies and pure protection term covers. Majority of life insurance companies had, in May and June, vociferously opposed this move citing an ALM (asset-liability management) mismatch as these are meant to be long-term plans and providing for liquidity in the interim is not the goal. They had argued that the new rules would not be in the interest of persisting (those who stay through the term) policyholders as their returns would be “Our alternative solution was to allow complete refund of premiums in case of mis-selling, rather than offering higher surrender values. The upfront charges are high and it is difficult to recoup the commissions paid in the initial years,” said the CEO of a large private life insurance company.

Advantage policyholders

However, some life insurers, besides experts, have supported the new regulations, asserting that policyholders would benefit, as many tend to let their policies lapse in the early years.

“At heart, the higher surrender value regulations treat the policyholders fairly (both lapsed and persistent), and prevent the insurers from excessively rewarding distributors at the expense of lapsed policyholders. The surrender value clause (after paying one annual premium) will force insurers to link commissions with persistency by moving to trail-based commissions, or having a claw back provision for the first year's commission, in case of early surrender,” said Avinash Singh, Senior Research Analyst, Emkay Global, in a note issued after the master circular's release. This could, theoretically, curb cases of mis-selling to an extent.

According to Emkay's calculations, a policyholder buying a non-par endowment policy with an annual premium of Rs 1.2 lakh, a five-year premium paying term, and a tenure of 10 years will now get Rs 1.06 lakh if she were to surrender after paying the first premium. At present, she has to forgo the entire amount.

Customer information sheet for easy decoding

While revision in surrender value norms is the most important change that will take effect from October 1, several other rules, too, will come into force for existing policies.

In the case of health and general insurance, the insurance regulator has made it mandatory for life insurers to issue a Customer Information Sheet (CIS) as part of the policy documents. The CIS is supposed to contain information on clauses, policy benefits, premiums, and terms and conditions in simple language and a concise manner, and will be of use to policyholders who find the complex language intimidating and difficult to comprehend. Insurers to pay more for ineffective grievance redressal

To resolve complaints about insurers not complying with the insurance ombudsman's orders on time, the IRDAI has introduced additional penalties. Insurers will now have to pay policyholders Rs 5,000 a day if they do not honour the ombudsman's order within 30 days.